VIX and Forex: A Quantitative Look at Global Risk Sentiment

“VIX represents global risk sentiment and uncertainty expectations.” ~ Russell Rhoads

We conducted an in-depth empirical study to examine how the VIX Index—often called the global “fear gauge”—influences major Forex currency pairs. The objective was to identify which currencies behave as risk-on assets and which act as safe-haven (risk-off) assets during periods of heightened market uncertainty.

Data & Methodology

Our dataset consists of:

Daily price data for 25 major Forex pairs

Daily VIX index values

Time period: 2010–2025

To ensure statistical accuracy, we:

Converted all price series into daily log returns

Aligned trading days across Forex and VIX data

Applied Ordinary Least Squares (OLS) regression for each currency pair

The regression model estimates a beta coefficient for each pair, which measures how sensitive that currency pair is to changes in the VIX.

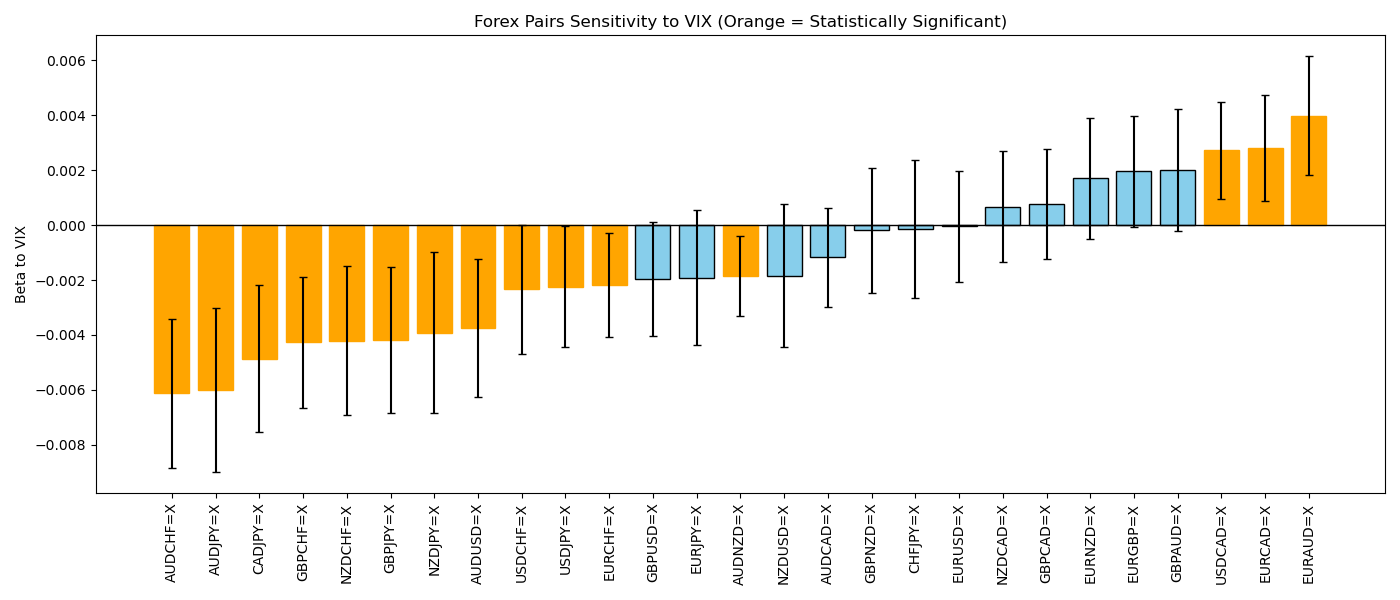

How to Read the Chart

From the visualization:

Blue bars → Overall VIX–Forex correlation

Orange bars → Statistically significant relationships (p < 0.05)

Horizontal zero line → Divides positive and negative sensitivity

Interpretation Rules:

Above 0 (Positive Beta) → Currency pair moves with VIX

→ Indicates risk-off / safe-haven behaviorBelow 0 (Negative Beta) → Currency pair moves against VIX

→ Indicates risk-on / growth-oriented behavior

Findings -

1. Risk-On Currencies (Negative VIX Sensitivity)

Several currency pairs show strong negative beta values, meaning they decline when VIX rises. These are typically:

AUD-based pairs

NZD-based pairs

Emerging or commodity-linked currencies

This confirms that risk-on currencies lose strength during volatility spikes, as investors exit risky assets.

2. Risk-Off / Safe-Haven Currencies (Positive VIX Sensitivity)

On the positive side of the chart, several USD, JPY, and CHF pairs demonstrate positive and statistically significant betas.

This means:

These currencies strengthen when risk rises

They act as safe-haven destinations during fear-driven market conditions

This validates well-known market behavior:

JPY, USD, and CHF gain strength during global stress

Statistical Significance Matters

Only the orange bars represent relationships strong enough to be trusted statistically. This eliminates:

Random correlations

Noise-based market movements

False signals

This makes the model reliable for:

Risk regime classification

Volatility-based trading strategies

Macro sentiment filtering

Trading & Risk Management Implications

This VIX-Forex sensitivity framework allows traders and portfolio managers to:

1. Identify which currency pairs to avoid during volatility spikes

2. Recognize safe-haven flows during global crises

3. Adjust portfolio exposure based on risk sentiment

4. Improve hedging strategies during uncertainty

5. Filter false breakout setups during fear-driven markets

For example:

If VIX is rising rapidly, risk-on pairs like AUD/USD or NZD/JPY become structurally weak.

Meanwhile, USD/CHF or JPY-based pairs gain defensive strength.

This analysis clearly demonstrates that VIX is not just an equity volatility index—it is a global macro risk indicator that directly impacts Forex markets. By statistically quantifying how each currency reacts to fear, traders gain a scientifically grounded tool for understanding market sentiment, capital flows, and volatility regimes.

Instead of reacting emotionally during high-volatility periods, this VIX-Forex sensitivity analysis allows traders to position with logic, probability, and macro alignment.