Wealth Management 301: Building a Smarter Strategy for Your Financial Future

With constant changes in the financial world and the fast pace of modern life, managing your wealth effectively has become more challenging than ever. Between rising living costs, market uncertainty, taxes and long-term goals like retirement, many people feel overwhelmed. That’s exactly where wealth management comes in.

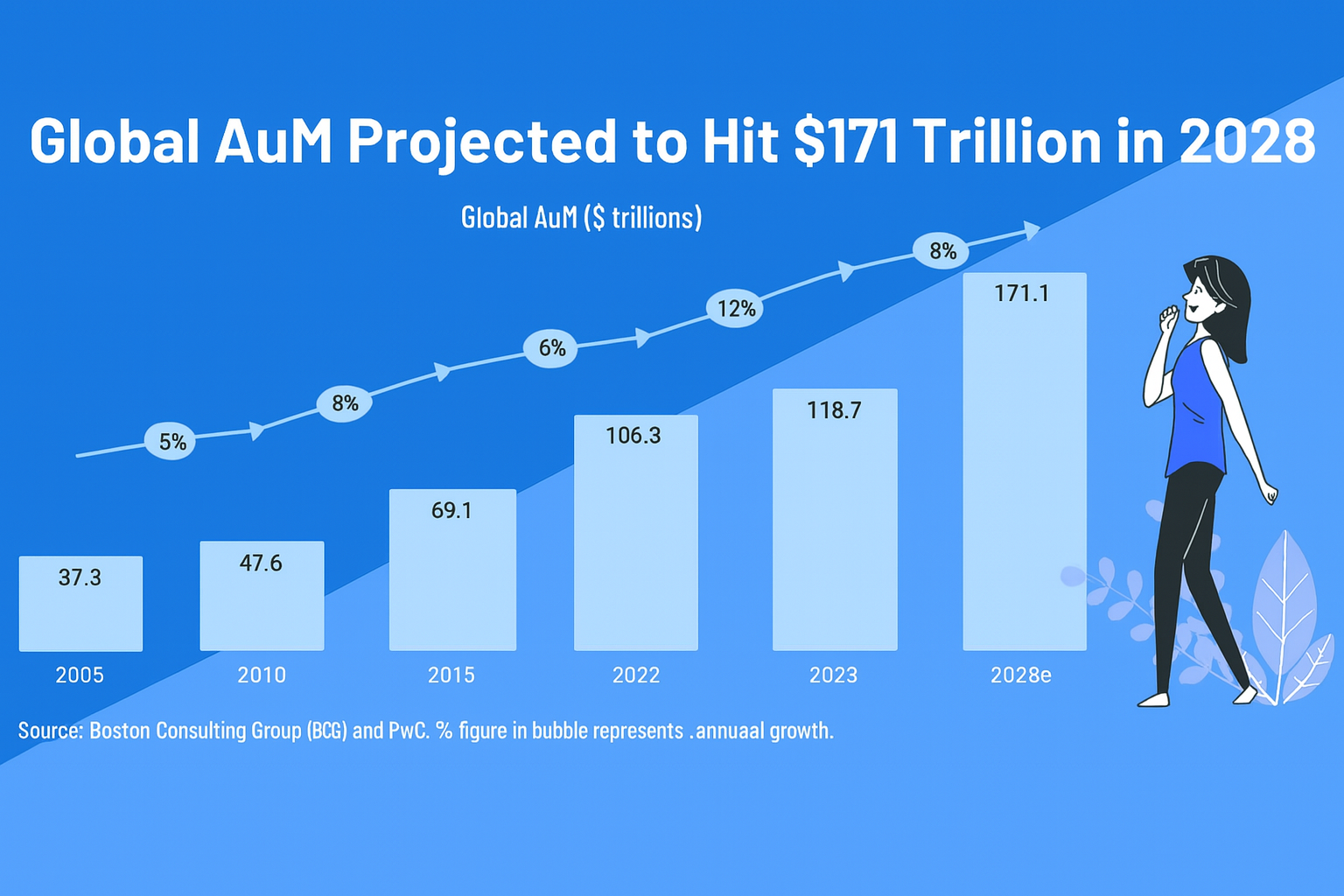

Whether you’re focused on growing your money, preparing for retirement, or doing both at the same time, wealth management brings everything together into one clear financial strategy. Let’s break down what wealth management really means, why it matters, and how it can help you create long-term financial security. By 2030, total investable wealth worldwide is projected to exceed US$481 trillion, two-thirds of which will come from mass-affluent and high-net-worth individuals (HNWIs). [Source : Yahoo Finance]

What Is Wealth Management?

Wealth management is a holistic approach to your entire financial life. It goes far beyond basic investing. Instead of focusing on just one area, it integrates:

Financial planning

Investment management

Tax planning

Retirement planning

Estate planning

Risk and insurance planning

All of this works together under one strategy designed around your personal goals, lifestyle and future needs. Unlike traditional financial services that look at things in isolation, wealth management connects all your financial decisions into one coordinated plan for long-term success.

Core Elements of Wealth Management

1. Financial Planning

This is the foundation of everything. It starts with clearly defining your short-term and long-term goals—whether that’s buying a home, funding education, starting a business or retiring comfortably. A solid financial plan considers your income, expenses, debts, savings and future responsibilities.

2. Investment Management

Here’s where your money starts working for you. A wealth manager builds and manages your investment portfolio based on your risk tolerance, time horizon, and financial objectives. This may include stocks, bonds, mutual funds, ETFs or alternative investments. Your portfolio is actively monitored and adjusted as markets and life circumstances change.

3. Tax Planning

Smart tax planning helps you keep more of what you earn. Wealth managers use tax-efficient investment strategies, timing of withdrawals, and charitable giving methods to reduce your tax burden legally and effectively—so your wealth can grow with fewer obstacles.

4. Retirement Planning

Retirement isn’t just about saving—it’s about planning how you’ll live. Wealth management helps determine how much you need, where to save, and how to invest so you can retire with confidence. This includes selecting accounts such as IRAs, 401(k)s and other retirement vehicles tailored to your needs.

5. Estate Planning

Estate planning ensures your wealth is protected and passed on according to your wishes. This includes wills, trusts, and beneficiary planning. Done correctly, it can also reduce estate taxes and prevent legal complications for your loved ones.

6. Risk Management

Life is unpredictable. Risk management protects your wealth through proper insurance planning—covering health emergencies, income loss, business risks and unexpected events that can otherwise derail your financial stability.

Key Benefits of Wealth Management

- A Personalized Financial Strategy

- Professional Guidance

- A Holistic View of Your Finances

- Long-Term Wealth Preservation

- Peace of Mind

Who Consider Wealth Management?

Wealth management can benefit anyone, but especially :

High Net-Worth Individuals: To grow wealth, reduce taxes, and structure estates efficiently.

Business Owners: To align business success with personal financial security and succession planning.

Pre-Retirees & Retirees: To transition from saving to living off investments without outliving savings.

Families Planning for the Future: To transfer wealth smoothly and tax-efficiently to future generations.

Among adults earning over US$100,000 per year in the U.S., 83% have a retirement savings plan — a much higher rate than those earning less, where only 28% do. [Source: Gallup.com]. It’s a long-term financial partnership designed to help you grow, protect and pass on your wealth with confidence.

How to Choose the Right Wealth Manager

Choosing the right advisor is a crucial decision. Here’s what to look for:

Proven Experience & Credentials: Look for designations like CFP or CFA.

Services That Match Your Needs: Whether it’s retirement, tax optimization, or investments.

Transparent Fee Structure: Understand how they charge—AUM, hourly, or flat fees.

Trust & Integrity: Your wealth manager should be transparent, reliable and act in your best interest.

Whether your goal is financial growth, retirement security, tax efficiency or estate protection, wealth management offers the clarity, control and expert guidance needed to build lasting financial success—making it a smart choice for everyone who wants to secure their future.

When you work with a seasoned wealth manager, you’re not just managing money—you’re building a secure financial future for yourself and your family.